cares act stimulus check tax refund

If not theres still time to register your 2019 tax refund for direct deposit. The CARES Act made the following changes to the NOL rules.

Coronavirus Irs Sends Stimulus Checks To Deceased Americans Warns Relatives Forgery Is A Federal Crime Abc7 San Francisco

Now you would expect a 2200 refund 5300 paid minus the 3100.

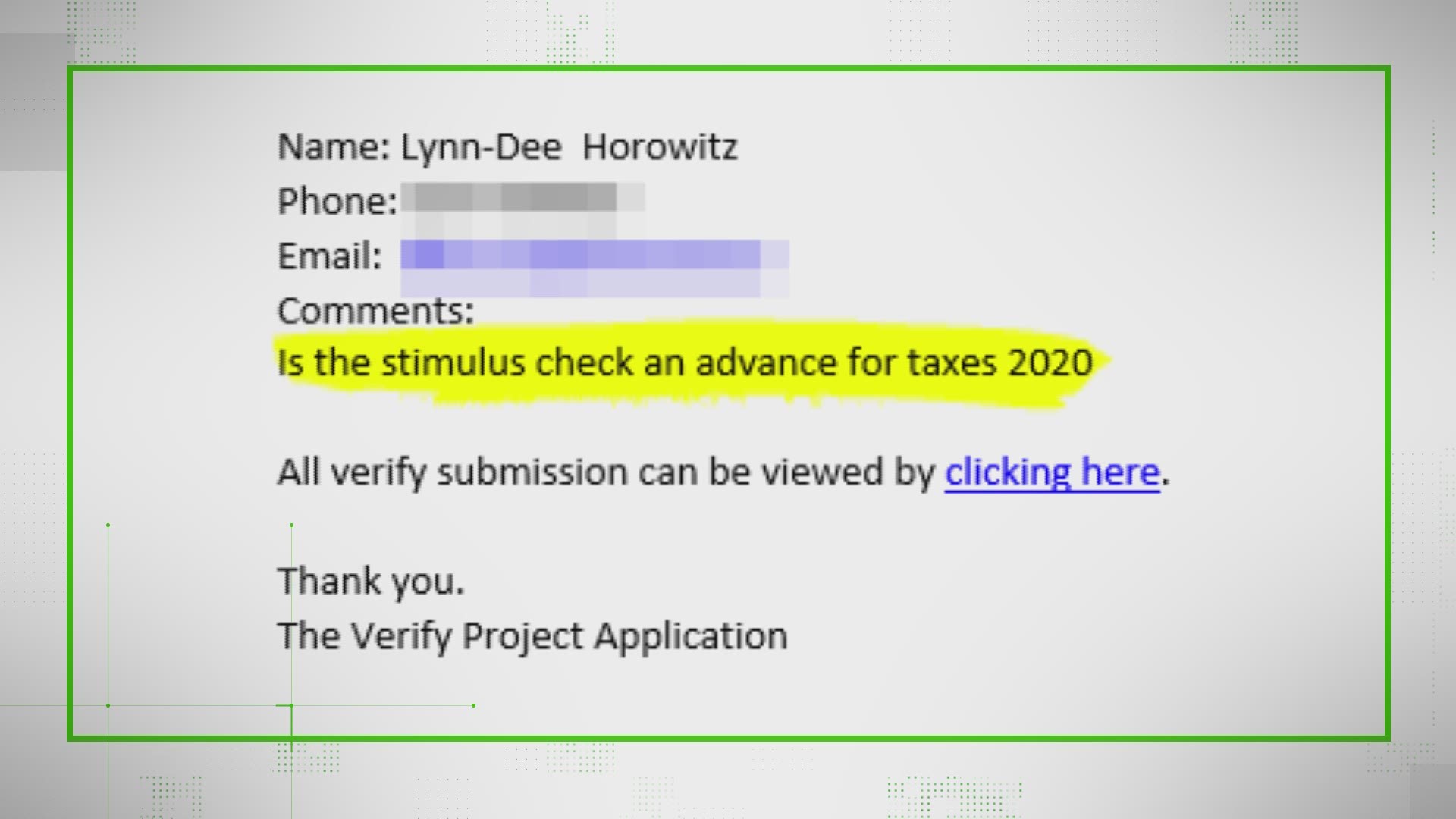

. People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return. The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return. CARES Act - 10 Early Withdrawal Penalty Exception.

With the CARES Act you receive an additional credit for 1200 and your tax liability is lowered from 4300 to 3100. As a result of the CARES Act which became law on March 27 2020 most Americans will receive stimulus checks. Due to erroneously filed 2018 or 2019 tax returns Form 1040 as a resident alien for tax purposes some of non-resident aliens for tax purposes may have received a stimulus payment under the CARES Act.

For the stimulus checks will we be required to match the name from the direct deposit to the account. And for each child under the age of 17 parents will get 500. The Treasury Department and the Internal Revenue Service today announced that distribution of Economic.

Single adults with a Social Security number and adjusted gross income of. At least in part - some of the provisions of the CARES Act. Varying Rates Of Earned Income Tax Credit.

Under the law the Fund is to be used to make payments for specified uses to States and certain local governments. Locally on May 13 Central Alabama Community College CACC received over 12 million dollars from the HEERF. The Internal Revenue Service IRS may not have considered the number of non-resident aliens who incorrectly filed a federal tax return.

This has not been specifically addressed in the CARES Act or relevant guidance specifically related to stimulus checks. As part of the 22 trillion CARES Act the federal government will issue payments - by check or direct deposit - to millions of income-qualified Americans. CARES Act Coronavirus Relief Fund frequently asked questions.

Of course there are some stipulations. The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US. Wheres my 3rd round stimulus payment.

This is what we mean by stimulus check The purpose of the payments is to help people cover basic necessities at a time when many have been told to stay home and have lost income. This rule changed for the second stimulus check which could not be issued if you owed child support. My husband has been working on.

What is a tax refund interest check. Single taxpayers will get 1200. For net operating losses NOLs generated in tax years beginning after December 31 2017 and before January 1 2021 taxpayers can carry such losses back to the 5 th year preceding the loss year.

Otherwise you will receive your check in the mail. The stimulus payment both first stimulus payment under the CARES Act and the second round of payments under the COVID-related Tax Relief Act of 2020- are treated as advance payments shall be adjusted against the eligible amount of recovery rebate credit. That said there were no stimulus checks included.

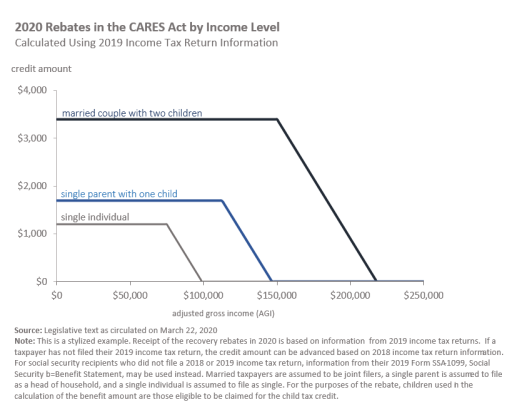

It is estimated that the cost of giving an extra tax refund would amount to 75 million and it would be covered from the federal COVID-19 relief funds that the state got under the CARES Act. Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID-19 pandemic in the United States. The payments phase out for people with income over 75000 for an individual or 150000 for a married couple.

This year we were supposed to get a huge tax return. Married taxpayers will get 2400. Irs Treas 310 Tax Ref Stimulus Check.

As most Americans know by now the CARES Act instructs the IRS to send every non-dependent with a social security number a payment of 1200 for an individual 2400 for a married couple with an additional 500 for each child. Stimulus Is the third stimulus payment taxable on my 2021 tax return. Stimulus Check Information - CARES Act.

You may soon receive a 1200 or 2400 stimulus check from the government if you set up your tax refund with direct deposit though it will be a longer wait if you need a paper check. And like the second check your third check cannot be used to repay child support. The CARES Act.

The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund. If youve already provided your bank account information to the IRS for tax refund purposes the payment will go straight to your bank account. Im not sure if this is the appropriate place to post this.

Here are four things to know about the CARES Act. Under the March 2020 CARES Act state and federal agencies can seize your first stimulus check to cover child support. Higher Education Emergency Relief Fund HEERF serves as a form of financial relief for colleges and universities who have been forced to resort to distant learning whilst the COVID-19 pandemic has swept the nation.

Have you received direct deposit tax refunds in the past. However the treasury has stated for regular tax refund ACHs that the bank is not required. If I took a retirement distribution due to Covid-19 will it be taxable on my 2020 return.

Like old NOL rules taxpayers can elect to forgo the carryback period and instead carryforward. As a result to COVID-19 the Federal Government is taking action to ease the burden to taxpayers by passing the Coronavirus Aid Relief and Economic Security Act HR 748 also known as the CARES Act. The spending primarily includes 300 billion in one-time cash payments to.

How do I complete the Recovery Rebate Credit. They were issued in 2020 and early 2021. How do I report Form 8915-E.

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Did Cares Act Benefits Reach Vulnerable Americans Evidence From A National Survey

Average Tax Refund Up 11 In 2021

Key Dates For The Next Set Of Stimulus Payments The Washington Post

Trump Signs Covid Relief Bill 600 Stimulus Checks Go Out This Week

Treasury Is Needlessly Requiring Millions Of Veterans Seniors To File Taxes To Receive Stimulus Checks The Hill

Irs Urges Non Filers To Register To Get Stimulus Checks By Year End

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Social Security Recipients Should Expect Stimulus Payment By April 7 Says Irs The Washington Post

Stimulus Payments May Be Offset By Tax Debt The Washington Post

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

You May Be Eligible To Receive 5 000 On Your Tax Refund Thanks To Stimulus Law Wset

Covid 19 And Direct Payments To Individuals Summary Of The 2020 Recovery Rebates In The Cares Act As Circulated March 22 Everycrsreport Com

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

How The Recent Stimulus Checks Affect Your Ssdi Benefits Call Sam

Will The Stimulus Money Be Deducted From Your Refund Next Year 11alive Com

Faqs On Tax Returns And The Coronavirus

My Stimulus Check Went To The Wrong Bank Account Now What The Motley Fool